We help YOU design a benefits plan that actually benefits YOUR company.

Book an Appointment

You’ve poured sweat & tears into your business!

Don’t let your healthcare plan control your revenue. It’s time to take back control.

Book an AppointmentIf you do nothing, you’re going to leave a lot of money on the table and be at the mercy of these traditional medical plans.

Manage your healthcare plan with ease and focus on what matters most—your business revenue.

Know exactly where your money is going, helping you avoid surprises and make smart decisions.

Get a healthcare plan that’s right for your business and your team, without overspending.

Plan ahead with more predictable renewals, keeping your revenue on track.

We help CFOs, business owners, and HR leaders who want to take back control of their healthcare premiums with a plan designed to provide clear, predictable costs year after year. This means no more surprise increases, allowing you to budget confidently and protect your revenue.

Our plans also offer better coverage for your employees, giving them the care they need while keeping your costs under control.

HR can experience lower out-of-pocket costs for their benefits program.

CFOs can grow net profit by 10 to 40% annually – based on the strategy chosen.

Owners can attract and retain talent while increasing productivity & revenue.

Learn why your health plan is designed to benefit everyone EXCEPT YOU and YOUR EMPLOYEES.

See your exact BENEFITS STRATEGY laid out in an easy-to-understand plan.

Leave traditional carriers behind and confidently MANAGE YOUR HEALTHCARE COSTS

See how companies gained control over their claims and saved an average of 27% on healthcare costs in just 2 years.

Download resources to see if your employee benefits plan helps YOU and YOUR BUSINESS

A managed risk plan — another term for a level-funded and self-insured plan — differs from a traditional medical plan because it offers more transparency in how your actual premium dollars are spent.

Traditional plans often keep key aspects like tax benefits, stop-loss insurance protection, savings on administrative costs and large claims, and control over claim reserves hidden, not sharing their true costs.

In contrast, managed risk plans provide transparency in these services with pricing, allowing for more effective management of claims and costs.

Traditional plans lack transparency and decision-making data, are overly complex, and are financially unpredictable — costs rise year after year. It’s estimated that these plans are going to double in the next 7 years.

The prevailing attitude has been «It is what it is.» For the past 10 years, CFOs have been told that change is not possible. Without even knowing if they are on a fully insured plan, how can they transition to a managed risk plan?

Traditional medical plans lack transparency, preventing companies from effectively managing medical expenses. As any CFO knows, if you can’t manage expenses, you can’t control costs.

Despite healthcare often being the second largest expense after payroll for many employers, it tends to receive little scrutiny, in contrast to much smaller expenses that are closely monitored.

The Manged Risk Plan employs a multitude of strategies. These include managing claim risks, lowering operating costs through smart plan designs, and provider networks & claim audits.

We improve cash flow and offer potential for surplus retention. We also provide tax benefits, stop-loss insurance protection, savings on administrative costs and large claims, and control over claim reserves.

The Manged Risk Plan uses real-time claims-data access and effective risk management to make accurate predictions about future renewals.

We design flexible plans concerning copays, deductibles, and steerage. Our strategy also includes a long-term focus on health insurance premiums, promoting transparency, and access to quality healthcare providers.

You can expect greater access to higher-quality providers, increasing clarity and transparency on your claims data which allows predictable medical renewals.

The plan also ensures faster claim resolution, offers customized reporting, and helps craft a competitive benefits package.

It gives you flexibility in plan design and enables better employee engagement. It offers independence from traditional fully-insured carriers and reduces carrier profit margins.

By adopting the Manged Risk Plan, we eliminate a layer of the traditional medical carriers, which in turn reduces carrier profit margins.

This means more of your money is spent directly on employee healthcare and not on padding the pockets of third-party insurers.

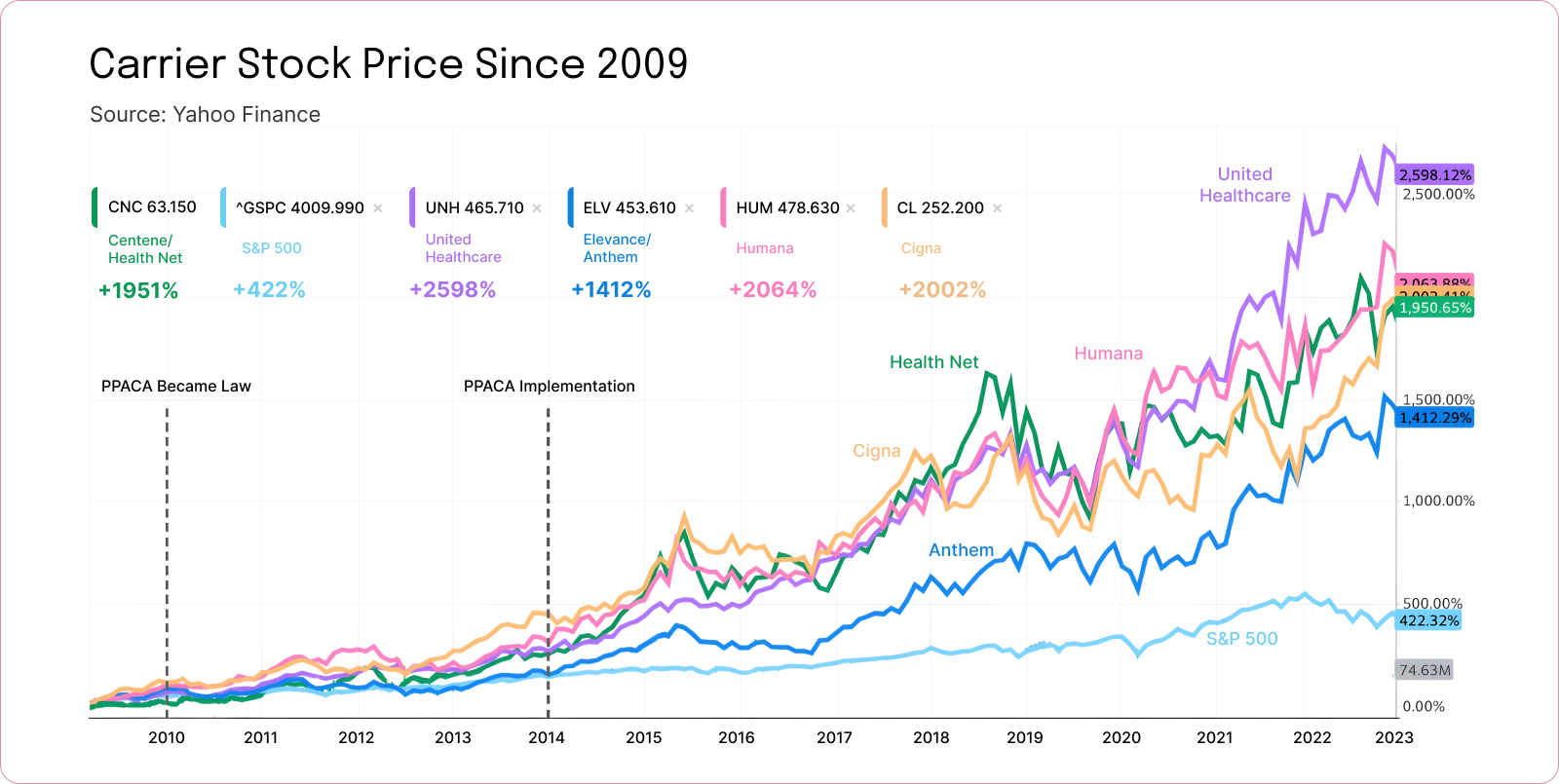

*Refer back to the carries profit graph

We use a third-party vendor that reviews, verifies, and confirms your medical claims are in line with your CPT procedure codes.

This ensures your employees receive the care they need without undue waiting, enhancing their experience and satisfaction.

It does involve a slightly more oversight, about 1 hours a month, but that can save you an extra 10-15% on your medical renewals.

Turning complex healthcare into a growth pathway for your business.

Health insurance plans are frustrating!

Premiums rise year after year, along with deductibles, copays, and out-of-pocket maximums.

In fact, medical premiums are expected to double within the next 7 years. That’s outrageous!

We’re so frustrated that we consistently searching for ways to beat the traditional (fully insured) group medical carriers.

That’s hard to do when the carriers are spending billions on lobbying efforts and posting record BILLION-dollar profits year after year.

Did you know the #1 reason people file bankruptcy is due to medical debt (46%) & the biggest surprise I learned was that 65% of them had health insurance.